고정 헤더 영역

상세 컨텐츠

본문

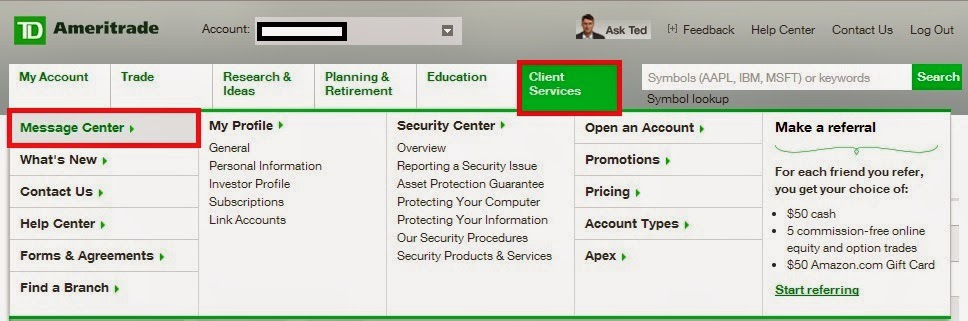

May 29, 2017 DDA is a term usually used in finance that is an abbreviation for “ Demand Deposit Account ”. This is a type of a checking account where the account holder can withdraw their funds “on demand”, or anytime. Oftentimes, employers like to use these types of accounts to deposit their employees’ salary. The term DDA is used in banking, and financial institution stands for “ Demand Deposit Account.” This checking account is for those who deposit or withdraw funds often. In a DDA account, you get facilitate to transfer money or withdraw funds anytime without even visiting your bank.

Close Account Due to Account Abuse?

Dda Account Number Bbva

11/24/2019

Dda Bank Account Definition

Dda Account Means

We have a customer who we recently refunded $630 of Returned NSF Fees and Continued Negative Balance Fees to after stating the items came thru sooner than scheduled (Reg E). The account went positive for one day and has now been negative for 17 days since (62 days NSF last 12 months). She has another account that is currently positive but that account has also had 41 days NSF. Can we close her accounts due to account abuse or failure to maintain account in a responsible manner?

댓글 영역